food sales tax in pa

While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The Pennsylvania sales tax rate is 6 percent.

Local Peeps We Just Were Invited From Park City Diner Lancaster Knight Day Diner Lititz To Take Part In Their S O S Sharin Supportive Sos Park City

Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166.

. Is food taxable in Pennsylvania. Drexel Hill PA Sales Tax Rate. Generally the sale of.

Returnable containers are not subject to tax. The 6 percent state Sales Tax is to be collected on every separate taxable sale in accordance with the tax table on Page 25. In the US each state makes their own rules and laws about what products are.

With local taxes the total sales tax rate is between 6000 and 8000. I Schools and churches. The sale of food or beverage items by D from the restaurant is subject to tax.

The following is what you will need to use TeleFile for salesuse tax. 6 Sale of food and beverages at or from a school or church. This page describes the taxability of.

The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable. Medical and Surgical Supplies. By Jennifer Dunn August 24 2020.

Nine-digit Federal Employer Identification. The Pennsylvania sales tax rate is 6 percent. Some examples of items that exempt from Pennsylvania.

In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in. Most people know the rules about food and clothing generally being exempt but state law details hundreds of categories and. The state sales tax rate in Pennsylvania is 6000.

Resources Blog Food. Statutory or regulatory changes judicial decisions or different facts may modify or negate the tax determinations as indicated. Clothing and food purchased at a grocery.

Food prepared in a private home may be used or offered for human consumption in a retail food facility if the following apply. Many third-party businesses offer online platforms or applications that allow customers to order food drinks groceries and other items from select retail stores and restaurants either with. Eight-digit Sales Tax Account ID Number.

By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when.

600 Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax Counties and cities can charge an additional local sales tax of up to 2. Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales tax. Pennsylvanias sales tax can be very confusing.

Select the Pennsylvania city from the list of popular. That makes the states sales tax average to be. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in or taking out. If this rule applies to you and you do not separately track sales of cold food.

Everything You Need To Know About Restaurant Taxes

Kennywood Ride Tickets Plus A Tax Ticket Talk About Responsibility For Little Kids Lol Pittsburgh Pennsylvania Pittsburgh Pa Pittsburgh Pride

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Explaining Taxes To The Kids A Christian Perspective Christian Perspective Tax Homeschool

What Services Are Subject To Pennsylvania Sales Tax

Printed Needle Punch Pattern Carrots For Applique Etsy In 2022 Punch Needle Patterns Punch Needle Embroidery Punch Needle

Pa Unemployment Base Year Chart Sales Taxes In The United States 350 275 Of Best Of Pa Unempl Tax Sales Tax Chart

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

Exemptions From The Pennsylvania Sales Tax

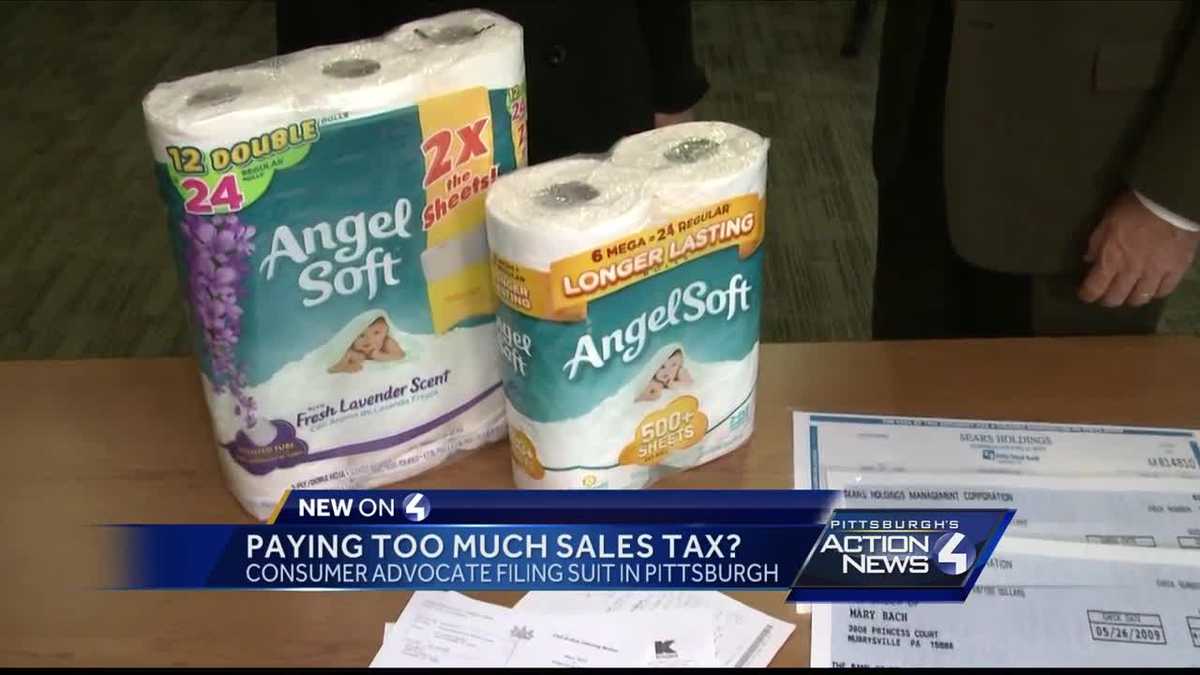

Pennsylvania S Quirky Sales Tax System Soft Drinks Are Taxed Candy Gets A Pass Pittsburgh Post Gazette

Pennsylvania Sales Tax Small Business Guide Truic

Is Food Taxable In Pennsylvania Taxjar

Different Location But Still Great Food Evelyn Wouldn T Have It Any Other Way Egg Sammy S Are Delicious A Roast Pork Sandwich Crispy French Fries Food

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

3 Vintage Cook Books Party Booklets Culinary Institute Recipe Books Patterns For Parties Osterizer Cook Book Vintage Recipes Kitschy In 2022 Vintage Recipes Book Party Vintage Cooking

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation