virginia military retirement taxes

A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. As you enter retirement dont let confusion about your taxes keep you from enjoying everything Virginia has to offer.

The Best Worst States For Military Retirees In 2022 Report Fox Business

State quarter Released in 2009 Lists of United States state symbols Washington DC formally the District of Columbia also known as just Washington or simply DC is the capital city and federal district of the United States.

. This is the login and information screen. 100 Milestone Documents from the National Archives a national initiative on American history civics and serviceThey were identified to help us think talk and teach about the rights and responsibilities of citizens in our. These documents were originally selected for the project Our Documents.

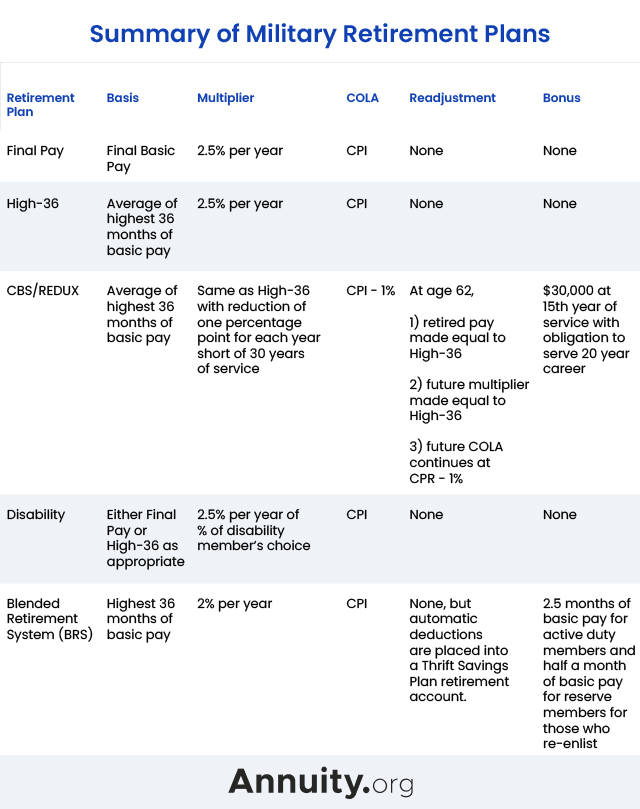

Retired Pay - Beginning in 2022 retirees 55 and older can deduct up to 10000 of retirement income from their gross income for. Under the new law starting in 2022 Virginia is making up to 10000 in military retirement pay tax-free for those ages 55 and older. VRS delivers retirement and other benefits to Virginia public employees through sound financial stewardship and superior customer service.

That amount increases by 10000 each year until 2025 when up to 40000 is deductible. Armed Forces should not be included in taxable income. Review the credits below to see what you may be able to deduct from the tax you owe.

Many states choose not to include military retirement pay in state income taxes whether its to acknowledge your service to your country or to make that state a more attractive place for veterans to live. Regulators are leaning toward torpedoing the Activision Blizzard deal. Military retirement pay is partially taxed in.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. The state income-tax deduction will increase by 10000 each.

Up to 24000 of military retirement pay is exempt for retirees age 65 and older. For state income taxes Virginia doesnt tax Social Security benefits and. In addition to that there are a number of government.

The first 35000 of any retirement income for Georgia residents 62 to 64 is exempt from state income taxes while the first 65000 of retirement pay. WTOP delivers the latest news traffic and weather information to the Washington DC. Financial advisors can also help with investing and financial planning - including retirement taxes insurance and more - to make sure you are preparing for the future.

Military retirement income is tax-free in Arizona too. Virginia Taxes on Military Disability Retirement Pay. 1 Economic Environment 2 Quality of Life and 3 Health Care.

And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Top Counseling Center 1-888-827-3847. While plenty of other states have more generous exemptions.

Some of the payments which are considered disability benefits include. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. Military retirement income received for service in the Armed Forces of the United States.

That amount increases by 10000 each year. In order to determine the best and worst states for military retirement WalletHub compared the 50 states and the District of Columbia across three key dimensions. The 687 billion Activision Blizzard acquisition is key to Microsofts mobile gaming plans.

20000 for those ages 55 to 64. See todays top stories. In 2022 up to 10000 of retirement pay is tax-free for retirees 55 and older.

This Friday were taking a look at Microsoft and Sonys increasingly bitter feud over Call of Duty and whether UK. The exemption covers people younger than 62. 4-year-old boy alerts 911 dispatcher after his mom had a seizure.

My Pay allows users to manage pay information leave and earning statements and W-2s. Up to 3500 is exempt Colorado. We evaluated those dimensions using 29 relevant metrics which are listed below with their corresponding weights.

Virginia - In 2022 up to 10000 in retirement pay is tax-free for retirees 55 and older. As you enter retirement dont let confusion about your taxes keep you from enjoying everything Virginia has to offer. Some tax this income fully and some impose a partial tax.

The commonwealth of Virginia provides several veteran benefits. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. It is located on the east bank of the Potomac River which forms its southwestern and southern border with the US.

Microsoft is quietly building an Xbox mobile platform and store. State of Virginia and it shares a land. With a few exceptions if a source of income is taxable at the federal level its taxable to Virginia as well.

Before you decide to move. 401k 403b and similar investments. Vermont Department of Taxes.

Virginia Taxes and Your Retirement Youve worked hard and now youre ready to move on to the next chapter of your life. Military Disability Retirement Pay received as a pension annuity or similar allowance for personal injury or sickness resulting from active service in the US. Up to 2000 of retirement income.

Beginning with your 2022 Virginia income tax return returns filed in 2023 you can claim a subtraction for certain military benefits if youre 55 or older. Virginia also has a large military presence with more than 25 military installations throughout the state. A note about the documents included on this page.

Hello and welcome to Protocol Entertainment your guide to the business of the gaming and media industries. This includes most sources of retirement income including.

Bill Would Eliminate Income Tax On Military Retirement Pay The North State Journal

How Is Your Military Pension Taxed Howstuffworks

Taxes On Military Pay Allowances

Tax Breaks For Disabled Veterans Military Com

5 Best States For Veterans To Retire

Virginia Tax Rebates On The Way State Revenues Up But So Is Inflation

Can You Receive Va Disability And Military Retirement Pay Cck Law

Virginia Military And Veterans Benefits The Official Army Benefits Website

Moaa State Tax Roundup New Year Will Mean Big Tax Breaks For Thousands Of Retirees

Maj Gen Crenshaw Keep Veterans In Virginia By Reducing Retirement Taxes The Roanoke Star News

State Lawmakers Have Taken Action To Help Veterans And Congress Is Seeking To Follow Suit

States That Don T Tax Military Retirement Pay Discover Here

Virginia Commonwealth Veteran Benefits Military Com

Tom Jurkowsky Granting Tax Relief To Military Retirees Can Boost The Md Economy Commentary Capital Gazette

7 States That Do Not Tax Retirement Income

West Virginia Is Third Best State For Retirement Survey Says Wboy Com

Youngkin Signs Tax Reduction For Veterans